Why Own Silver?

For over 5,000 years, silver has been used for currency. Ancient civilizations from the Greeks to the Romans circulated silver coins throughout their vast empires.

But beyond its long history as a currency, silver offers compelling advantages to modern investors who want to fortify their retirement portfolios, including the potential for significant price appreciation driven by high consumer and industrial demand.

As a vital component in cutting-edge technology, like solar panels, smartphones, and consumer electronics, silver has a high intrinsic value. And for retirement portfolios, silver may offer investors a hedge against economic downturns and market volatility.

Silver’s many uses make the precious metal a unique economic asset with the potential to deliver stability and growth. And for those interested in enhancing portfolio resilience within a comprehensive retirement defense strategy, silver may offer many benefits and rewards.

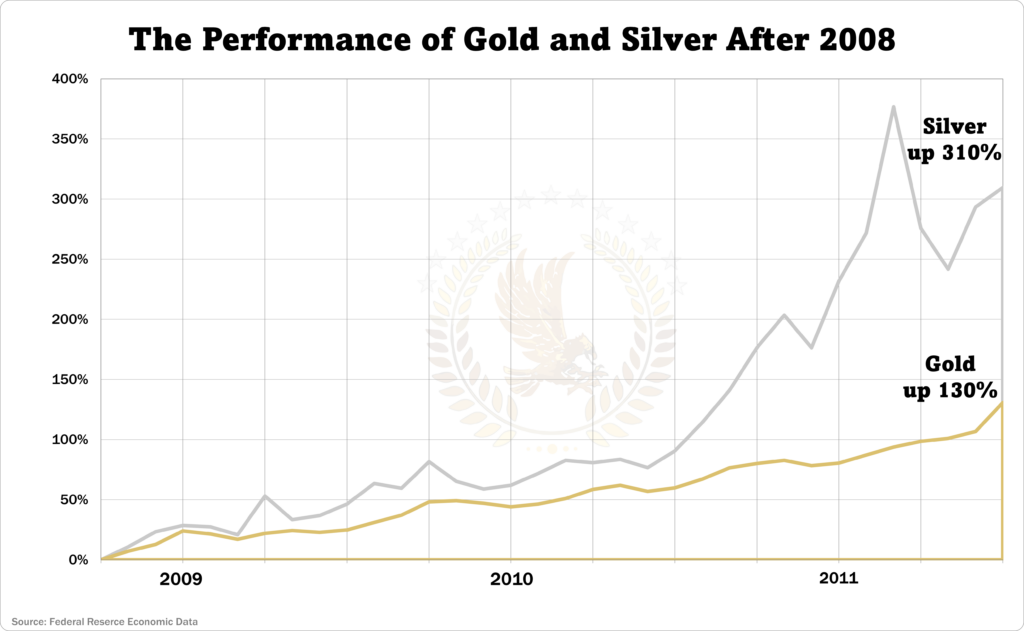

Historically, silver’s performance has outpaced gold when demand for precious metals rises

Silver prices tend to be more volatile than gold due to several key factors, including fluctuations in industrial vs investment demand and the fact that the silver market is smaller overall compared to gold, so smaller demand can drive significant price growth. This volatility can turn some investors off if they’re seeking stability. However, it’s precisely this volatility that can be a major advantage when precious metals enter a bull market phase, often triggered by economic upheaval.

The 1970s provide a prime example of silver’s performance. The decade saw double-digit unemployment, rampant inflation, and significant geopolitical turmoil. While failing stock markets drove many investors to gold, which climbed an impressive 1,754%, silver soared an astounding 2,490% over that same 10-year period.

More recently, the 2000s were marked by the global war on terror and the Great Recession that closed out the decade. Between 2000 and 2011, the price of gold rose a remarkable 542%. But silver again took the lead, skyrocketing 908%.

So, while gold may dominate the precious metals conversation in the financial media and among many investors, the historical record shows that silver may deliver superior returns compared to gold during periods of rapidly appreciating precious metals prices.

Market demand for silver is growing, but supplies are limited

Silver’s unique properties make it an essential component in a wide array of industrial and consumer products with surging demand – from solar panels and cellphones to computers, appliances, and electric vehicles.

The industrial need for silver makes up around 50% of the worldwide market today. Almost half of all silver mined throughout history has been used up industrially, destroyed, or thrown away, and experts believe another 47% is jewelry. That means only 3% of all the silver ever extracted – a mere $46 billion worth for all investors globally – remains for investment. When demand rises against this comparatively small investable silver supply, prices can jump considerably.

An undervalued precious metal

Comparing silver and gold prices can help determine whether silver is undervalued or overpriced.

Historically, gold has been 16 times more expensive than silver, but currently, gold is around 80 times pricier. Many precious metals analysts predict that the gap between gold and silver prices will close, with silver making up ground. This may leave ample room for silver to increase in value, potentially rising more than 4.5 times just to reach the historical gold-to-silver ratio.

Put simply, silver may be considerably undervalued right now, with significant potential for growth. We believe there’s a fantastic opportunity to purchase silver at a price possibly well below its actual worth.

This is on top of silver’s impressive historical returns during times of financial turmoil, even surpassing gold’s performance in these periods. In our view, this makes silver an essential asset for any portfolio.